Technical news

Topical Insight and Commentary from our Technical Experts

Latest in the press

Our Technical Services Team regularly provides commentary and insight in the media to deepen your understanding of the ever-changing financial landscape.

Media commentary

HMRC announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document. HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK

Total HMRC tax receipts for the April to May 2024 are £132.8 billion, which is £3.6 billion higher than last year.

Receipts were higher from Income Tax, Capital Gains Tax and National Insurance Contributions (NICs), business taxes and stamp taxes.

- Receipts were lower from VAT and fuel duty.

Inheritance Tax

- IHT receipts for April & May 2024 are £1.4 billion, which is £0.2 billion higher than the same period last year.

Andrew Tully, Technical Services Director at Nucleus said:

“These figures continue the strong upward trajectory in IHT receipts over the last few years. The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules. Both are currently intended to be frozen until 2028. Given all of this the need for expert financial planning remains crucial.

“Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

HMRC today announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document: HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK.

- Total HMRC tax receipts for the 2023/24 tax year are £827.7 billion, which is £39.1 billion higher than last year

- Receipts were higher from Income Tax, Capital Gains Tax and National Insurance Contributions (NICs), business taxes and VAT

- Receipts were lower from stamp taxes and Tobacco.

Inheritance Tax

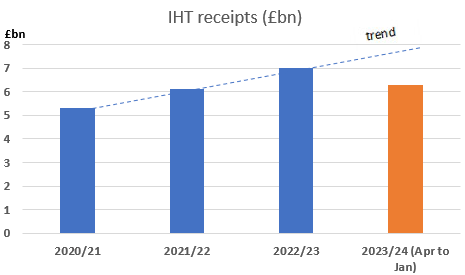

- IHT receipts for 2023/24 are a new record £7.5 billion, which is £0.4 billion higher than last year.

- This continues the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- Given all of this the need for expert financial planning remains crucial.

Andrew Tully, Technical Services Director at Nucleus said: “These are record IHT receipts following on from previous record highs in each of the last two years. The Office of Budget Responsibility predicts the IHT take will be £9.7bn in 2028/29 which means the impact of this tax is set to continue growing strongly.

Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

The FCA today released its retirement income data for 2022/23 (Retirement income market data 2022/23 | FCA).

A summary of the data is detailed in the table below.

| 2021/22 | 2022/23 | |||

|---|---|---|---|---|

| Number of plans | Monetary value (£000) | Number of plans | Monetary value (£000) | |

| Total pots accessed for first time | 705,661 | 45,638,188 | 739,535 | 43,199,189 |

| Annuities purchased | 60,574 | 5,153,150 | 59,163 | 4,060,947 |

| New drawdown policies entered into and not fully withdrawn | 205,641 | 31,794,619 | 218,074 | 29,867,353 |

| Pots where first partial UFPLS payment taken and not fully withdrawn | 36,271 | 3,693,212 | 41,571 | 4,002,707 |

| Full cash withdrawals from pots being accessed for first time* | 395,235 | 4,997,207 | 420,727 | 5,268,182 |

It shows:

- Slightly more pots (4.9% higher) were accessed for the first time in 2022/23 than in 2021/22 (739,535 vs 705,661).

- However the monetary value was down, suggesting more people took out slightly lower value withdrawals.

- The percentage of customers using the different solutions has remained broadly constant.

- In monetary terms the majority of funds go into drawdown.

- In customer numbers most take full cash withdrawals.

- Sales of annuities fell slightly, which is probably a surprise given rates have generally been good.

- The number of DB transfers continued to fall.

Andrew Tully, Technical Services Director at Nucleus Financial, said: “The effects of the cost-of-living crisis will unfortunately be felt for years to come, so it’s no surprise to see greater numbers of people making withdrawals from pensions than in the previous tax year. We have recently conducted some consumer research which revealed that 74% of UK adults cite ‘affordability’ as one of the issues that negatively affects their retirement confidence. That figure rises to 81% of those aged between 45-54. Many people need to access their pension while still working to pay unexpected bills or help wider family.

“Drawdown will remain the key retirement solution for many as it gives the flexibility to cope with changing needs in retirement. Given the ongoing freezing of the tax thresholds, being able to vary income to ensure it is taken as tax efficiently as possible is a key benefit. The increase in advised annuity sales isn’t a surprise given the significantly higher rates. But blending drawdown with a guaranteed income may give a better outcome than solely using an annuity.

“Given the range of retirement options available, it is important consumers get good advice at the point they first access their pensions savings and on an ongoing basis to work out the best options for their individual circumstances.

“Drawdown advice can be complex, covering areas such as the sustainability over a long time period; the ideal investment options; and tax advice, including how to pass on wealth efficiently to family. Advisers need to be clearly documenting their advice as that is one of the areas the FCA focused on during its retirement income advice review.”

HMRC has announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document. HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK (www.gov.uk)

- Total HMRC tax receipts for April 2023 to January 2024 are £695.1 billion, which is £33.6 billion higher than the same period last year.

- IHT receipts for April 2023 to January 2024 are £6.3 billion, which is £0.4 billion higher than the same period last year

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may either scrap IHT entirely or cut the headline rate in the Budget on 6 March

- However, even if IHT were scrapped it is possible some tax would apply to assets passed on after death – for example, Capital Gains Tax.

- The Labour party has said that if it wins the election it would reverse any abolition of IHT.

- Given all of this the need for expert financial planning remains crucial.

Andrew Tully, Technical Services Director at Nucleus said: “It looks set to be another record-breaking year for IHT receipts. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions, given this year’s receipt are on track for around £8bn.

There are rumours the Government may consider changes to, or even the abolition of, IHT. However, with the possibility of other taxes applying to assets passed on after death, and Labour saying it would reverse any abolition, the need to engage early with planning and advice is crucial. Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

Nucleus has reignited its call for an independent long-term savings commission with an open letter to the pensions minister and his counterparts across political parties.

The firm urges there needs to be greater cross-party agreement for pension and savings policy to ensure more people can feel confident about their retirement prospects..

It has called for a stop to the constant tinkering to pension tax rules, which is deterring people from engaging with the pension system.

Nucleus has written to pensions minister Paul Maynard and shadow minister for pensions Gill Furniss, among others, highlighting that pension savers want to see a stable tax and policy environment.

The pension legislation merry-go-round of recent years has further eroded trust at a time when people need to be saving more for later life.

Auto-enrolment has successfully created millions of new savers, but people are not saving anywhere near enough for a comfortable retirement.

Nucleus highlights the policy, proposed by an independent Pensions Commission in 2005, had wide cross-political party support from the outset and continues to do so today.

It suggests a similar independent body needs to be established now to bring the much-needed consistency to pension savers.

The letter follows a research study conducted by Nucleus last year in which it asked the thought-provoking question: ‘How confident are you that you’ll have enough money to live comfortably for the rest of your life?’

As part of the 2023 Nucleus UK Retirement Confidence Index, 2,000 adults aged 50 and over were polled by YouGov to gauge how they feel about some of the most important decisions they will need to make around retirement.

The study highlighted pension savers want to have trust in the long-term savings market. It included consumer and adviser research and demonstrated the need for greater collaboration to effect positive change.

This new annual index will track UK retirement confidence over time. The inaugural report contained 14 calls to action for the industry, policy makers and consumers, around pensions legislation, financial education and communication.

One of the major arguments put forward was the need for an independent long-term savings commission. Nucleus has reiterated this call in the letter.

Andrew Tully, Technical Services Director at Nucleus and author or the letter, said: “To make meaningful positive change to long-term savings habits, our recent UK Retirement Confidence Index highlighted that we need more people to save more into their pension, to understand why they are saving and what for, and are empowered to save in an environment of trust and stability.

“Our research suggests constant tinkering and changes to rules has a negative impact on confidence. Setting up an independent long-term savings commission to depoliticise and develop proposals for pension and savings policy would bring much needed consistency and stability, which would deliver greater levels of trust and engagement.”

Nucleus outlines the aim of such a non-departmental public body would be to review the regime for UK pensions and long-term savings and make recommendations accordingly.

HMRC today announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document.

Key points

- Total HMRC tax receipts for April 2023 to December 2023 are £580.8 billion, which is £26.0 billion higher than the same period last year.

- IT receipts for April 2023 to December 2023 are £5.7 billion, which is £0.4b billion higher than the same period last year.

- There are rumours the Government may either scrap IHT entirely or cut the headline rate in the March Budget.

For more information, check out the latest press release