Media hub

Check out our media centre which houses a wide range of resources for journalists looking for the latest Nucleus news, articles and media contacts.

18 July 2024

Nucleus appoints platform directors to support new platform launch

Nucleus Financial Platforms (Nucleus), one of the UK’s leading, independent, adviser platform groups, has announced Laura Papp and Helen Wallace-Smith have joined into two newly created platform director roles.

Read our latest press releases

1 July 2024

Nucleus completes acquisition of Third Financial

Nucleus Financial Platforms (Nucleus), one of the UK’s leading, independent, adviser platform groups has announced the completion of the acquisition of Third Financial, following regulatory approval from the Financial Conduct Authority (FCA) in May this year.

26 June 2024

Nucleus finds majority unaware of possibility to contribute to someone else’s pension

Research from Nucleus, one of the UK’s leading, independent, adviser platform groups, has revealed 76% of people are unaware they can pay money into someone else’s pension.

5 June 2024

Nucleus finds majority of UK adults sceptical about state pension future

Nucleus Financial Platforms Group (Nucleus), one of the UK’s leading, independent, adviser platform groups, has released new research revealing that 71% of UK adults believe the state pension will not exist or will be less generous when they retire.

Like to stay in touch?

If you're a journalist and would like to receive our corporate announcements please email:

News archive

- Nucleus Financial Platforms has reached an agreement to acquire Third Financial, one of the fastest growing investment platform and software providers in the UK.

- The acquisition is subject to regulatory approval and will enable Nucleus to offer a full range of platform solutions to meet the needs of advisory and wealth firms, including ‘adviser-as-a-platform’.

- Third Financial will continue to be led by existing Chief Executive Ian Partington, and benefit from the opportunities provided by the wider group.

Nucleus Financial Platforms, one of the UK’s largest adviser platform groups with over £80bn of assets under administration from 250,000 customers, announces the acquisition of Third Financial.

Third Financial is a leading investment platform and front-to-back wealth management software provider, serving discretionary wealth managers, multi-family offices, and adviser consolidators.

The business has delivered strong organic growth in recent years, with revenue increasing by more than 30% in 2023. It has over 50 clients in the UK with £6bn of assets under administration on its platform and a further £40bn of assets administered via its software system, Tercero.

The acquisition will enable Nucleus to extend the platform solutions it offers advisory firms of all sizes. As well as the existing leading retail retirement platform and specialist SIPP and SSAS products, Nucleus will benefit from Third Financial’s proprietary technology, enabling an enhanced ‘adviser-as-a-platform’ proposition to meet the needs of larger businesses who want to offer their own platform.

The move represents a sizeable growth opportunity, as research by NextWealth* showed that an increasing number of larger advisory groups were exploring establishing their own platform as a way of increasing revenue, reducing risk, and improving operational efficiency. The key benefit to advisers of this approach is the provision of greater control over the products, service, and price.

The combination with Third Financial is fully aligned with the group’s strategic ambition of building scale and capability through organic growth and compelling acquisition opportunities.

Upon completion, the group’s platform AUA is expected to be circa £90bn.

Richard Rowney, Chief Executive Officer of Nucleus, said: “We're delighted to announce the acquisition of Third Financial. By combining our scale, expertise and relationships, with their innovative technology, we’ll be able to offer a broader proposition to serve the needs of wealth managers and advisory businesses across the sector.

“We’ve long admired the team that Ian has built at Third Financial and what they’ve achieved. Their focus on innovation and client centricity has clearly differentiated their business, establishing them as one of the leading investment platform providers, and they will be a great addition to our group.”

Ian Partington, Group Chief Executive of Third Financial added: “A crucial factor in the decision to join Nucleus is that we feel very culturally aligned. Delivering excellence for our clients has always been core to our success, and in the Nucleus team we found that quality fully reflected.

“Now with our combined expertise and resource we can deliver even more to existing and future clients both in terms of products and service. Collectively our focus will remain on running a stable and profitable expanded service, continuing to support clients so they can deliver great outcomes for their customers.”

Nucleus is being advised by Fenchurch Advisory Partners and Slaughter and May.

Third Financial is being advised by GP Bullhound and Osborne Clarke.

* NextWealth the Great Platform Shakeout Report January 2023

Research by NextWealth showed that an increasing number of larger advisory groups were considering offering their own platform, as a way of reducing their risk and improving operational efficiency. The key benefit to advisers of this approach is that it provides more control over the products, service and price.

You can download a PDF of the press release here

ENDS

Enquiries:

Linda Harper

Head of Public Relations - Nucleus Financial Platforms group

E: newsroom@nucleusfinancial.com

T: +44 (0) 7876 145309

Tom Allison/Shan Willenbrock

TB Cardew

T: 0778 9998020/07775 848537

Notes to editors:

About Nucleus

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

About Third Financial

Third Financial is the UK's leading investment platform for the thinking wealth adviser and manager.

It brings together its own market-leading technology and the expertise of over 100 industry professionals within a culture of exceptional client service.

It provides the core processing, asset servicing and market connectivity for the management of over £50bn of assets.

It delivers a full digital experience to wealth professionals and their clients with the reassurance of friendly and expert support when required.

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform groups, has announced the removal of exit fees for customers of Curtis Banks SIPP products.

The change will apply to transfers out to UK based pension schemes and annuity purchases.

It follows the removal of the remaining exit fees on James Hay products last year, as well as a further reduction in the price of Nucleus Wrap.

Nucleus’ commitment to using its scale to invest in price has saved the group’s customers over £5m in the last two years, with a further £5m expected to be saved in 2024 through the combined price reductions.

Mike Regan, Nucleus Chief Commercial Officer, said: “I’m pleased that following our acquisition of Curtis Banks last year, we’re now removing exit fees. We don’t believe any customer should face unreasonable barriers to exit if they wish to leave, for whatever reason.

“Looking ahead to 2024 we’re excited about the prospect of continuing to invest in our products, service and price, enabling us to deliver great financial outcomes for our customers and ultimately helping make their retirement more rewarding.”

The exit charges this applies to are as follows:

- Final payment and closure of pension charge

- Transfer out charge

- Annuity purchase charge

- Forwarding monies post pension closure charge

You can download a PDF of the press release here

ENDS

Enquiries:

Linda Harper

Head of Public Relations - Nucleus Financial Platforms group

E: newsroom@nucleusfinancial.com

T: +44 (0) 7876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus has reignited its call for an independent long-term savings commission with an open letter to the pensions minister and his counterparts across political parties.

The firm urges there needs to be greater cross-party agreement for pension and savings policy to ensure more people can feel confident about their retirement prospects..

It has called for a stop to the constant tinkering to pension tax rules, which is deterring people from engaging with the pension system.

Nucleus has written to pensions minister Paul Maynard and shadow minister for pensions Gill Furniss, among others, highlighting that pension savers want to see a stable tax and policy environment.

The pension legislation merry-go-round of recent years has further eroded trust at a time when people need to be saving more for later life.

Auto-enrolment has successfully created millions of new savers, but people are not saving anywhere near enough for a comfortable retirement.

Nucleus highlights the policy, proposed by an independent Pensions Commission in 2005, had wide cross-political party support from the outset and continues to do so today.

It suggests a similar independent body needs to be established now to bring the much-needed consistency to pension savers.

The letter follows a research study conducted by Nucleus last year in which it asked the thought-provoking question: ‘How confident are you that you’ll have enough money to live comfortably for the rest of your life?’

As part of the 2023 Nucleus UK Retirement Confidence Index, 2,000 adults aged 50 and over were polled by YouGov to gauge how they feel about some of the most important decisions they will need to make around retirement.

The study highlighted pension savers want to have trust in the long-term savings market. It included consumer and adviser research and demonstrated the need for greater collaboration to effect positive change.

This new annual index will track UK retirement confidence over time. The inaugural report contained 14 calls to action for the industry, policy makers and consumers, around pensions legislation, financial education and communication.

One of the major arguments put forward was the need for an independent long-term savings commission. Nucleus has reiterated this call in the letter.

Andrew Tully, Technical Services Director at Nucleus and author or the letter, said: “To make meaningful positive change to long-term savings habits, our recent UK Retirement Confidence Index highlighted that we need more people to save more into their pension, to understand why they are saving and what for, and are empowered to save in an environment of trust and stability.

“Our research suggests constant tinkering and changes to rules has a negative impact on confidence. Setting up an independent long-term savings commission to depoliticise and develop proposals for pension and savings policy would bring much needed consistency and stability, which would deliver greater levels of trust and engagement.”

Nucleus outlines the aim of such a non-departmental public body would be to review the regime for UK pensions and long-term savings and make recommendations accordingly.

You can download a PDF of the press release here

A full copy of the letter follows:

Proposal to establish an independent long-term savings commission

Nucleus is one of the largest, independent investment platforms in the UK. We help over 250,000 customers manage a collective £80bn of their wealth, exclusively through independent financial advisers. Our purpose is to help them make retirement more rewarding.

We take our responsibility as the custodian of customers’ money very seriously. As such, we believe the UK needs greater political consensus around pension and long-term savings, to help more people save more for their retirement in an environment of trust and stability.

One way to achieve this would be to establish an independent long-term savings commission.

We recently conducted a major piece of customer research, The Nucleus UK Retirement Confidence Index. Via YouGov, we sought to assess whether people over the age of 50 have confidence they’ll be able to retire comfortably.

In these uncertain times, with widespread cost-of-living concerns and volatile markets, it’s more important than ever for people to feel confident about their financial future.

Our research clearly – and predictably - highlights those with defined benefit (DB) pensions are most confident. But we know DB is in sharp decline following most private schemes being closed to new joiners or bought out over the past 20 years, and there’s a rapidly growing reliance on defined contribution (DC) pension provision. We’ve evidenced that those relying solely on DC pensions are much less confident of their financial future.

Automatic enrolment is one key policy that has been a huge success in getting more people to save for their retirement, within the DC environment. This policy was proposed by an Independent Pensions Commission in 2005. Perhaps at least partly because it was proposed by an independent body, the introduction of auto-enrolment had from outset, and continues to have, wide cross-political party support.

While auto-enrolment has successfully created millions of new savers, it’s widely agreed that people are not saving anywhere near enough. The complexity of retirement and tax planning involved in turning a pot of money into a retirement income can’t be overstated.

Added to that people need to decide when and how to use money held in other assets such as ISAs, investments and property, alongside pension savings.

There are many persuasive reasons for people to not engage with their retirement, both practical and psychological.

Building up informed, appropriate retirement confidence will require co-operation, communication, and collaboration. Each and every participant in the retirement income sector has a role to play – and should feel obliged to play.

A key area highlighted within our research is the desire for pension savers to have trust in the long-term savings market and have a stable tax and policy environment. Pensions are a long-term investment, and over many years, under various different governments, there have been constant changes and tinkering to the pension tax rules which deter people from engaging with the pension system, and negatively affects their confidence.

To make meaningful positive change, our research highlights we need more people who save more into their pension, to understand why they are saving and what for, and are empowered to save in an environment of trust and stability.

It’s for this reason that we believe the creation of an independent long-term savings commission is needed. The aim for this non-departmental public body would be to review the regime for UK pensions and long-term savings and make recommendations accordingly. Its existence should make it easier to gain cross-party support for proposed changes and engender more stable pensions and long-term savings policy. And ultimately give more confidence in retirement.

I’m more than happy to meet and discuss our research and thoughts in more detail, along with our CEO, Richard Rowney. I look forward to hearing from you.

Yours sincerely

Andrew Tully

Technical Services Director

ENDS

Enquiries:

Linda Harper

Nucleus Financial Platforms group

T: 07876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £89 billion in assets under administration, helping nearly 5,500 advisers make retirement more rewarding for almost 235,000 customers.

To find out more visit: www.nucleusfinancial.com

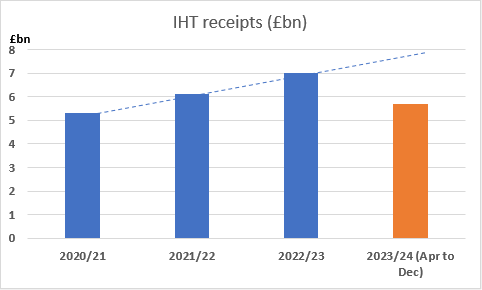

HMRC announces the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document. HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK (www.gov.uk).

- Total HMRC tax receipts for April 2023 to December 2023 are £580.8 billion, which is £26.0 billion higher than the same period last year.

- IHT receipts for April 2023 to December 2023 are £5.7 billion, which is £0.4bn billion higher than the same period last year.

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may either scrap IHT entirely or cut the headline rate in the March Budget.

- However, even if IHT were scrapped it is possible some tax would apply to assets passed on after death – for example, Capital Gains Tax.

- The Labour party has said that if it wins the election it would reverse any abolition of IHT.

- Given all of this the need for expert financial planning remains crucial.

Andrew Tully, Technical Services Director at Nucleus said:

“It looks set to be another record-breaking year for IHT receipts. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions, given this year’s receipt are on track for around £8bn.“There are rumours the Government may consider changes to, or even the abolition of, IHT. However, with the possibility of other taxes applying to assets passed on after death, and Labour saying it would reverse any abolition, the need to engage early with planning and advice is crucial. Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

To download the PDF click here

Enquiries:

Linda Harper

Nucleus Financial Platforms group

T: 07876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self-invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform groups, has today announced that after a distinguished period of technical leadership and delivery, Andrew Smith is stepping down as Chief Digital Officer from the end of the year.

Richard Rowney, Nucleus Chief Executive Officer said: “Andrew has been a key part of Nucleus throughout its journey. He was one of the team that helped launch the wrap platform in 2006, playing a pivotal role by ensuring we focused on the needs of advisers in those early years. After rejoining in 2015, he’s greatly contributed to the growth and transformation of the business, leading the development of our proposition through our investment in digital and technology.

“As part of my leadership team for the last two years, his support and contribution through the integration of Nucleus and James Hay has been invaluable. I would like to thank him for his commitment and leadership and wish him the very best for the future.”

Andrew Smith, Nucleus Chief Digital Officer said: “I’ve spent much of my career at Nucleus so it’s very much part of my DNA, but after a total of 13 years, I feel that now is the right time to look for a new challenge.

“I’m really proud of what we’ve achieved. From a start up in Edinburgh in 2006 to the scale business we are today, it’s been a quite remarkable journey, not least as we’ve held onto our founding principle of serving the needs of advisers and delivering great customer outcomes. It’s been a privilege working with such brilliant teams over the years and I look forward to watching the continued success of the company.”

You can download a PDF of the press release here

Enquiries:

Linda Harper

Nucleus Financial Platforms group

T: 07876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform groups, has today announced it’s reducing the standard annual Nucleus Wrap platform charge by three basis points for holdings between £200k and £500k.

- The cut will deliver an average 3.2% reduction for eligible customers.

- Under the new standard pricing structure, a customer with assets of £500,000 would see their charge reduced by £450 over five years.

The rate cut is effective from 1 December and is the second major investment in reducing price for customers in the last 18 months. In July 2022, the headline annual platform charge was cut from 35 to 33 basis points.

Nucleus’s commitment to investing in price has saved the group’s customers over £5m in the last two years, with a further £5m expected to be saved in 2024 through the combined price reductions.

Mike Regan, Chief Financial Officer at Nucleus said: “We’ve been clear that as we build scale this allows us to invest more in our service, product and price. I’m pleased that we are now sharing the benefit of our increased scale by introducing our second annual rate cut for Nucleus Wrap.

“This latest price reduction increases our competitiveness, and more importantly, delivers an improved outcome for many of our customers, who collectively will have saved more than £10m by the end of next year.

“Over the last 18 months we’ve invested more than £20m in our proposition, service and price as we deliver against the priorities of advisers, helping them to make their clients’ retirement more rewarding.”

New Nucleus Wrap customer standard charging structure

|

Previous charges |

New charges |

||

|---|---|---|---|

|

Tier |

Standard charge |

Tier |

Standard charge |

|

£0 to £0.5m |

33bps |

£0 to £0.2m |

33bps |

|

|

|

£0.2m to £0.5m |

30bps |

|

£0.5m to £1.0m |

17.5bps |

£0.5m to £1.0m |

17.5bps |

|

£1.0m+ |

5bps |

£1.0m+ |

5bps |

You can download a PDF of the press release here

Enquiries:

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus Financial Platforms Group one of the UK’s leading, independent, adviser platform groups, has appointed Alexander Filshie as Chief Financial Officer (CFO), subject to regulatory approval.

He starts today taking over from Mike Regan who, as previously announced, has been appointed as Chief Commercial Officer. Mike Regan replaces Alex Kovach who leaves at the end of the year. Alexander will join the Nucleus Executive Committee as well as the Board.

Alexander is an experienced board level CFO with a track record of success in M&A and delivering business transformation across both global blue chip businesses and fast moving fin-tech, payment and financial services institutions.

His experience spans private equity, public market and institutional ownership and during his thirty year career he has led high performing teams to support ambitious growing businesses.

Alexander joins from specialist mortgage lender, Kensington Mortgages where he was CFO for three years. Prior to this, he was Chief Financial Officer at Visa Payments Ltd.

He has an impressive breadth of experience across the financial services sector, starting his career at PWC and then Standard Chartered, before going on to hold senior positions at global organisations including Barclays and American Express. He has also held CFO roles across smaller specialized financial services groups and fintechs including World First and CLS Group.

Richard Rowney, Chief Executive Officer at Nucleus, said: “Alexander has three decades of experience in the financial services sector and brings with him knowledge and expertise that will be instrumental in helping us to deliver on our strategy, as we continue to invest in our platform and build scale.

“This is an exciting time in our journey and I look forward to having Alexander in my executive team as we build the UK’s leading, independent, adviser platform.”

Alexander Filshie, Nucleus CFO, added: “I’m delighted to be joining Nucleus at this exciting time, as it embarks on the next phase of its journey to become a scale player in the market, with a clear commitment to invest in the priorities of advisers and to deliver on its purpose to help make retirement more rewarding for customers.

“I’ve been extremely impressed by the trajectory of the business and in particular the vision and ambition of Richard and the wider executive team. With strong shareholder backing, and a strategy that is clearly working, Nucleus is well positioned to continue to capture the significant opportunities that exist in the platform market.”

You can download a PDF of the press release here

Enquiries:

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

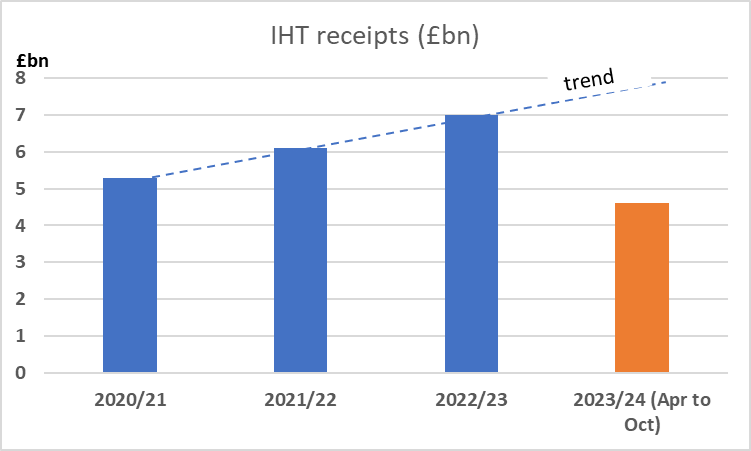

HMRC today announced the latest Inheritance Tax (IHT) receipts. < HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK (www.gov.uk)

- For April 2023 to October 2023 these are £4.6 billion, which is £0.5 billion higher than the same period last year.

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may cut the headline rate of IHT in the Autumn Statement tomorrow.

Andrew Tully, Technical Services Director at Nucleus said: “It looks set to be another record-breaking year for IHT receipts, unless the Government moves to cut the headline rate as rumours suggest. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions.

“Engaging early with good planning and advice can help to reduce or mitigate IHT. There are a number of ways advisers can help manage an estate for IHT purposes including setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

You can download a PDF of the press release here

Enquiries:

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 6,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

- Nucleus UK Retirement Confidence Index is 6.9 with a negative outlook

- Findings show planning drives considerable influence on retirement confidence

- 49% of people aged over 50 do not have a detailed retirement plan

- Only 16% of UK adults are ‘totally confident’ they have enough money to retire in comfort

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform groups, today launches the UK Retirement Confidence Index.

The comprehensive study, the first of its kind, involved surveying more than 2,200 UK adults aged 50 and over by YouGov. It’s based on responses to the central question of how confident those approaching or in retirement feel about having enough money to live on for the rest of their lives.

It reveals the confidence index is 6.9 out of 10, with a negative outlook.

Although this ‘score’ is higher than some might have predicted, there’s detail that indicates underlying sentiment points to challenges ahead for some groups of people who are less confident than others.

Planning significantly affects confidence. Just over half of respondents (51%) have a detailed plan for retirement. Only 20% have their plan in writing, but this doesn’t seem to affect confidence (8.1 vs 8.0).

Those without a detailed plan have the lowest confidence (4.6). These results clearly indicate that planning is a key driver to people feeling positive about securing a rewarding retirement.

But despite the power of planning, half of UK adults (49%) approaching retirement don’t have a detailed plan in place.

The negative outlook on the overall 6.9 index score reflects the rapid decline of defined benefit (DB) pension provision and inadequate defined contribution (DC) savings pots. It also speaks to more general concerns about the cost of living for 80% of respondents and inflation for 63%.

One of the most interesting findings in the report is that advice itself does not seem to have a material impact on the confidence of those people approaching or in retirement, though it is slightly higher for advised customers at 7.0 compared to a confidence score of 6.8 for those who have never taken advice.

Experience also boosts confidence scores

The research also shows that people who have drawn on their pension savings report higher levels of retirement confidence than those who have not, regardless of whether they have taken advice. Those who have received advice and accessed their savings score 7.2, compared to 6.6 for those who haven’t accessed their pension funds. Non advised participants of the survey who’ve accessed their pension pots score a confidence rating of 7.3 compared to just 5.7 for those with pensions untouched.

This may be explained by the fact that retirees have experienced the immediate and tangible benefits of their savings or perhaps feel buoyed by a lump sum. Although the concern here is that consumers’ decision making may be short term and to the detriment of quality of life in later years.

Two thirds of respondents’ report being ‘confident’ they will have enough to retire comfortably though just 16% are ‘totally confident’. This sentiment is largely attributed to an absence of debt.

Risk appetite higher for advised consumers

When looking at investment risk attitudes, the overall tendency is for people to take a very low level when it comes to investing for retirement, with a mean score of 3.2 out of 10. However, consumers who have had financial advice show the highest mean risk appetite at 3.9, indicating advised clients perhaps have a better or more informed attitude to risk.

Interestingly, the respondents with the highest retirement confidence score - those who have not received financial advice - have the lowest appetite for risk with a mean score of just 2.6. The implication here is that people are missing out on potential growth opportunities in their portfolio – through not engaging with advice – which may impact the size of their pension pot.

Richard Rowney, Chief Executive Officer at Nucleus, said: “Our purpose is to help make retirement more rewarding. To do that we need to understand how people at this stage of life feel and what influences their decisions.

“We firmly believe in the value of planning and advice, which is why we’ve invested in this study. We set out to learn more about how we can help people live fulfilling lives in retirement, and how we and others in the industry might address potential issues getting in the way.”

Andrew Tully, Technical Services Director at Nucleus added: “Among the many interesting findings, the stand-out piece of data for me is that advice itself does not necessarily lead to more confidence, but planning absolutely does. What that tells me is that we should all perhaps be looking at the advice gap from a different angle.

“If we focus on taking actions that lead people to engaging with the planning process, advice, and implementation of products, if required, will naturally follow. That for me is a new way of looking at the problem of engagement.”

He added: “We’re pleased to see people saying they are more confident than we anticipated though we need to urge caution here, for two reasons. The first is that confidence does not necessarily equate to people making the best decisions when it comes to pension planning. So, we would always encourage people to seek out professional help if they can.

“And the second reason for caution is that we believe retirement confidence is very likely to reduce over time due to dwindling numbers of defined Benefit arrangements and an increase in reliance on inadequately funded Defined Contribution plans. Auto-enrolment has been a huge success in getting many more people to save for their retirement. But we can’t stop there, the next challenge is to get more people saving more.”

2023 UK Retirement Index: 14 things the sector should do

Platforms and other providers:

- Make the pensions dashboard work: the quality of data is key to empowering customers to act and make informed choices.

- Free movement of pension funds: yes, we need checks and protection from foreseeable harms, but they should be proportionate to the likely level of risk.

- Better consumer communication: clear, concise, and standardised plan information that anyone can understand, with easier access to information. There may also be some who recognise a need to act but simply don’t know how to. One solution is to make the steps towards guidance and advice much clearer.

- Championing financial advice: commit to seeing through necessary service and technology developments, easing the advice process, and making professionals’ lives simpler. The benefits of planning and advice can be life changing – but these must be promoted if they are to help shift the dial on advice take-up.

Advisers:

- Clear communication of services and costs: with so many variants of financial advice services, consumers cannot be expected to know the difference.

- Embrace planning: it’s clearly vital to retirement confidence for consumers and holistic planning isn’t always part of the financial advice process. It needs to be.

Regulators:

- Highlight the benefits of regulated advice: and the dangers of not seeking it.

- Prioritising the real risks: more focus on the immediate dangers and bad players, with more effective use of resources. Don’t let the desire for a perfect outcome get in the way of a good customer outcome.

- Target social media: tough regulation, targeting the ‘finfluencers’ with heavy penalties.

Government:

- Make a plan to increase pension saving: most experts accept an 8% auto-enrolment contribution isn’t sufficient. We should aim for contributions to start gradually increasing before 2027, fifteen years after the introduction of auto enrolment.

- Make the pensions dashboard happen: make it soon and make it effective. This will simplify and speed up the process of finding and consolidating pension funds. The same point stands for a solution to the small pots problem.

- Clear, effective, and accessible communication and education: about the need for retirement planning and the risks of not doing so.

- Funding and promoting financial education in schools: We need to normalise saving into a pension from as early an age as possible.

- Stop the pension legislation merry-go-round: pensions are a long-term arrangement, and the legislative process should reflect that. Setting up an ongoing Independent Pensions Commission to develop long-term proposals for pensions and savings policy would bring much-needed consistency.

You can download a PDF of the press release here

Enquiries:

Nucleus

Linda Harper

Head of Public Relations

T: +44 (0) 7876 145309

The lang cat

Mark Locke

Communications director

T: +44 (0) 7718 424711

About the research

The consumer research was carried out online by YouGov between 10 and 16 August 2023. The sample consisted of 2,208 UK adults aged 50 and over and who have pension pots or pension entitlements other than the State Pension.

The questionnaire covered a range of factors which play varying roles in driving retirement confidence up or down. These include type(s) of pension saved into, whether respondents have accessed their pension(s), whether they’ve taken advice, whether they’ve a plan for retirement, other assets available age gender employment status.

The lang cat, an insight, research and communications agency, specialising in financial services carried out the adviser and planner research interviews. They questioned advice professionals drawn from both their own adviser panel and the Nucleus Advisory Board.

The lang cat’s panel consists of more than 1,300 advice professionals representing a cross-section of firms and role types. The Nucleus Advisory Board plays a crucial role in planning and decision making across the business. Questions were structured around some key data findings to capture reactions, opinions and insight.

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 6,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform groups, explains the impact of today’s inflation figures on triple lock calculations for state pensions from April 2024 and calls for a sensible discussion around the future of the triple lock and the state pension system as a whole.

What was announced this morning

- CPI Inflation for the year to September 2023 was 6.7%, the same rate as August (Consumer price inflation, UK - Office for National Statistics). This means prices are rising at the same fairly high rate as the previous month, well above the Bank of England’s 2% target

- September’s inflation figure is particularly important as it drives increases to many state benefits, increases in many pensions in payment from public sector pension schemes, and is part of the triple lock calculation for state pensions

- The triple lock means state pensions increase by the highest of inflation, earnings and 2.5%

This year the highest of those three is the 8.5% increase in earnings in July (this is higher than the CPI inflation of 6.7% to September and the fixed 2.5%). However there are suggestions the Government may use a lower figure of 7.8% as this is earnings growth excluding bonuses. The total increase in earnings is affected by one-off payments made to the NHS and civil service in June and July 2023.

The potential new state pensions from April 2024

- If the headline single tier state pension increased by 8.5%, from April 2024 it would be £221.20 a week, up from the current £203.85 a week

- If it was increased by the lower 7.8% figure it would be £219.75 a week

- The maximum basic state pension paid to those who reached state pension age before 6 April 2016 is currently £156.20 a week and it would increase to £169.50 s week (assuming 8.5% increase) or to £168.40 (at 7.8%)

- While these are the headline rates many people receive less

- An 8.5% increase in state pensions will cost around £7.6bn a year, whereas a 7.8% increase would cost approx. £7bn, so there is a significant saving if the Government use the lower earnings figure, excluding bonuses

- The Government will make an announcement on State Pension uprating later this autumn confirming the final figures

Andrew Tully, Technical Services Director at Nucleus said: “The large increase in the state pension from April 2024 will be a welcome boost to the many people who are struggling given the current cost of living crisis. The last couple of years has taken its toll on finances, with many having to make difficult choices to make ends meet.

“Like many people we believe that the triple lock is not sustainable over the long term. We need a sensible discussion around the future of our state pension system as a whole.

“This includes what a reasonable state pension provision looks like and potential future increases to state pension age, as well as the future of the triple lock. The wider debate could also consider differing life expectancy across the UK, increasing private pension savings through auto-enrolment, and support for those below state pension age who aren’t able to work.

“A separate issue is there is a growing likelihood more pensioners will start paying income tax. The combination of large increases to state pensions over the last couple of years coupled with the freezing of most tax thresholds, mean the state pension will likely be around £11,500 a year, getting close to the personal allowance threshold of £12,570 where people start to pay income tax. The intention is the personal allowance will remain frozen until at least March 2028, which raises the possibility the headline state pension may overtake it at some point.”

The history of the triple lock

The triple lock was introduced from 6 April 2011 and means the basic state Pension and Single Tier State Pension increase by the highest of earnings, inflation (CPI) and 2.5%.

Since 2011/12, the state pension has been increased as shown in the table below.

| Tax year | Rise in state pension | Based on |

| 2011/12 | 4.6% | RPI(1) |

| 2012/13 | 5.2% | CPI |

| 2013/14 | 2.5% | Fixed 2.5% |

| 2014/15 | 2.7% | CPI |

| 2015/16 | 2.5% | Fixed 2.5% |

| 2016/17 | 2.9% | Earnings |

| 2017/18 | 2.5% | Fixed 2.5% |

| 2018/19 | 3% | CPI |

| 2019/20 | 2.6% | Earnings |

| 2020/21 | 3.9% | Earnings |

| 2021/22 | 2.5% | Fixed 2.5% |

| 2022/23 | 3.1% | CPI(2) |

| 2023/24 | 10.1% | CPI |

(1) RPI inflation was the previous basis for State Pension indexation before the triple lock and the Government chose to use it in 2011/12

(2) Due to the impact of the Covid pandemic the Government chose to suspend the triple lock and use the higher of CPI and the fixed 2.5%

You can download a PDF of the press release here

Enquiries

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 6,000 advisers make retirement more rewarding for almost 250,000 customers.

Useful downloads

Here's our logo with three different versions available. Please email our graphic designer Iona Sorbie if you’d like an alternative version.

Check out our latest Illuminate articles